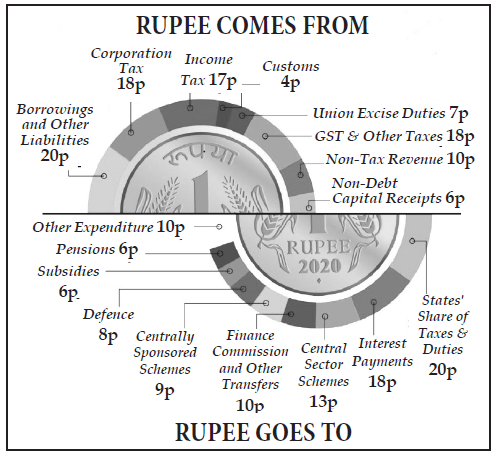

Presenting the first Union Budget of the third decade of 21st century, Finance Minister Smt. Nirmala Sitharaman, on 01.02.2020 unveiled a series of far-reaching reforms, aimed at energizing the Indian economy through a combination of short-term, medium-term, and long-term measures. The Union Budget has been structured on the overall theme of “Ease of Living.” The Key Highlights of Union Budget 2020-21 are as follows :

UNION BUDGET 2020 – 2021 : AT A GLANCE

| 2018-19 (Actuals) (in crore) | 2019-20 (Budget Estimates) (in crore) | 2019-20 (Revised Estimates) (in crore) | 2020-21 (Budget Estimates) (in crore) | |

| Revenue Receipts | 15,52,916 | 19,62,761 | 18,50,101 | 20,20,926 |

| Capital Receipts | 7,62,197 | 8,23,588 | 8,48,451 | 10,21,304 |

| Total Receipts | 23,15,113 | 27,86,349 | 26,98,552 | 30,42,230 |

| Total Expenditure | 23,15,113 | 27,86,349 | 26,98,552 | 30,42,230 |

| Revenue Deficit | 4,54,483 | 4,85,019 | 4,99,544 | 6,09,219 |

| Effective Revenue Deficit | 2,62,702 | 2,77,686 | 3,07,807 | 4,02,719 |

| Fiscal Deficit | 6,49,418 | 7,03,760 | 7,66,846 | 7,96,337 |

| Primary Deficit | 66,770 | 43,289 | 1,41,741 | 88,134 |

Agriculture, Irrigation and Rural Development

The Finance Minister announced that more than Rs.2.83 lakh crore would be spent on Agriculture, Rural Development, Irrigation and allied activities.

Agriculture credit target for the year 2020-21 has been set at Rs.15 lakh crore. All eligible beneficiaries of PM-KISAN will be covered under the Kisan Credit Card scheme.

Moreover, comprehensive measures for one hundred water stressed districts, proposal to expand PM-KUSUM to provide 20 lakh farmers for setting up stand-alone solar pumps and for another 15 lakh farmers to solarise their grid-connected pump sets, setting up of efficient warehouses at the block/taluk level are also announced.

In Horticulture sector with focus on “one product one district” for better marketing and export; are some of the steps announced in the direction of ‘doubling the farmers’ income.

Foot and Mouth disease, brucellosis in cattle and also peste des petits ruminants (PPR) in sheep and goat to be eliminatated by 2025.

Coverage of artificial insemination to be increased from the present 30% to 70%. MGNREGS to be dovetailed to develop fodder farms, doubling of milk processing capacity from 53.5 million MT to 108 million MT by 2025 are also announced.

Similarly on the Blue Economy, raising of fish production to 200 lakh tonnes is proposed by 2022-23. Youth to be involved in fishery extension through 3477 ‘Sagar Mitras’ and 500 Fish Farmer Producer Organisations. Fishery exports are expected to be raised to Rs.1 lakh crore by 2024-25.

Under the Deen Dayal Antyodaya Yojana scheme, 0.5 crore households are mobilized with 58 lakh SHGs and it will be further expanded.

To build a seamless national cold supply chain for perishables (milk, meat, fish, etc.), ‘Kisan Rail’ to be setup by Indian Railways through PPP. Under this project express and freight trains to have refrigerated coaches.

‘Krishi Udaan’ to be launched by the Ministry of Civil Aviation on international and national routes. This will immensely help to improve value realisation on agricultural products, especially in North-East and tribal districts.

‘Jaivik Kheti Portal’ – online national organic products market and Zero-Budget Natural Farming to be strengthened.

The budget also proposed the integration of Negotiable Warehousing Receipts (e-NWR) with National Agricultural Market (e-NAM).

To promote storage infrastructure and reduce wastage of food grains, the budget proposed ‘Village Storage Scheme’ to be run by Self Help Groups (SHG). It also quoted, “Women, SHG’s shall regain their position as ‘Dhaanya lakshmi’.

Education and Skill Development

The Budget lays special emphasis on the employability and quality aspects of education. Finance Minister announced that a total outlay of Rs.99,300 crore has been earmarked for the education sector in 2020-21 and Rs.3000 crore for Skill Development. “By 2030, India is set to have the largest working age population in the world”, she added.

Finance Minister further announced that about 150 Higher Educational Institutions will start apprenticeship embedded degree/diploma courses by March 2020-21. This will help to improve the employability of students in the general stream (vis-a-vis services or technology stream). The government will also start a program whereby urban local bodies across the country would provide internship opportunities to fresh engineers for a period of up to one year. National Skill Development Agency will give special thrust to infrastructure-focused skill development opportunities, the Minister explained.

The Finance Minister, in her speech also said that the New Education Policy will be announced soon.

Degree level full-fledged online educational programme will be started to provide quality education to students of deprived sections of the society as well as those who do not have access to higher education.

The Finance Minister observed that India should be a preferred destination for higher education. Therefore, under its “Study in India” programme, an Ind-SAT is proposed to be held in Asian and African countries for benchmarking foreign candidates who receive scholarships for studying in Indian higher education centres.

In order to meet the requirement of qualified medical doctors, it is proposed to attach a medical college to an existing district hospital in PPP mode.

A National Police University and a National Forensic Science University have also been proposed in the domain of policing science, forensic science, cyber-forensics etc. in the Budget.

The Finance Minister announced setting up of a National Recruitment Agency (NRA) as an independent, professional, specialist organisation for conducting a computer-based online Common Eligibility Test for recruitment to Non-Gazetted posts.

Women and Child, Social Welfare

Emphasising on nutrition as a critical component on health, Finance Minister proposed to provide Rs.35,600 crore for nutrition-related programmes for the year 2020-21. She drew attention to the ‘Poshan Abhiyan’ which was launched in 2017-18 to improve the nutritional status of children (0-6 years), adolescent girls, pregnant women and lactating mothers.

The Union Minister further said that more than six lakh anganwadi workers had been equipped with smart phones to upload the nutritional status of more than 10 crore households, which was an unprecedented development.

To address the issue on ‘age of a girl’ entering the motherhood, Finance Minister proposed to appoint a task force for this purpose which would present its recommendations in six months’ time.

Highlighting the government’s continued commitment to the welfare of women, the Minister proposed an outlay of about Rs.28,600 crore for programs that were specific to women.

The Finance Minister proposed a budget provision of about Rs.85,000 crore for 2020-21 to further the government’s commitment towards the welfare of Scheduled Castes and Other Backward Classes. The Minister also provided an allocation of Rs.53,700 crore for the year 2020-21 for further development and welfare of Scheduled Tribes. Further, keeping in mind the concerns of senior citizens and Divyang, the Finance Minister proposed an enhanced allocation of about ` 9500 crore for 2020-21 in the Union Budget.

Wellness, Water and Sanitation

Dwelling on the Wellness, Water and Sanitation theme, Finance Minister said Rs. 69,000 crore is being provided for Health care including Rs.6400 crores for Prime Minister Jan ArogyaYojana (PMJAY).

“TB Harega Desh Jeetega” campaign to end Tuberculosis by 2025, expansion of Jan Aushadhi Kendra Scheme to all districts offering 2000 medicines and 300 surgicals by 2024 are some of the other wellness measures announced in the Budget. On sanitation front, Government is committed to ODF Plus in order to sustain ODF behaviour and the total allocation for Swachh Bharat Mission is Rs.12,300 crore in 2020-21. Similarly, Rs.3.60 lakh crore approved for Jal Jeevan Mission ( Rs.11,500 crore in 2020-21).

Industry, Commerce and Investment

Referring to the theme of Economic Development, the Finance Minister said that Rs.27300 crore would be allocated for development and promotion of Industry and Commerce for the year 2020-21. An Investment Clearance Cell will be set up to provide “end to end” facilitation. It is proposed to develop five new smart cities in collaboration with States in PPP mode.

A scheme to encourage manufacture of mobile phones, electronic equipment and semi-conductor packaging is also proposed. A National Technical Textiles Mission would be set up with a four-year implementation period from 2020-21 to 2023-24 at an estimated outlay of Rs.1480 crore to position India as a global leader in Technical Textiles.

To achieve higher export credit disbursement, a new scheme, NIRVIK is being launched to support mainly small exporters. Government e-Marketplace (GeM) is moving ahead for creating a Unified Procurement System in the country for providing a single platform for procurement of goods, services and works. It is proposed to take the turnover of GeM to Rs.3 lakh crores. 3.24 lakh vendors are already on this platform. In order to reduce the compliance burden on small retailers, traders, shopkeepers who comprise the MSME sector, the Finance Minister has proposed to raise by five times, the turnover threshold for audit from the existing Rs.1 crore to Rs. 5 crore. In order to boost less-cash economy, she has proposed that the increased limit shall apply only to those businesses which carry out less than 5% of their business transactions in cash.

Infrastructure

On Infrastructure sector as highlighted by the Prime Minister that Rs.100 lakh crore would be invested over the next 5 years, National Infrastructure Pipeline was launched on 31st December 2019 at the outlay of Rs.103 lakh crore. It consists of more than 6500 projects across sectors and are classified as per their size and stage of development.

The Minister said that about Rs.22,000 crore has already been provided as support to Infrastructure Pipeline. Accelerated development of highways will be undertaken. This will include development of 2500 Km access control highways, 9000 Km of economic corridors, 2000 Km of coastal and land port roads and 2000 Km of strategic highways.

Delhi-Mumbai Expressway and two other packages to be completed by 2023. Chennai-Bengaluru Expressway project also be started. It is proposed to monetise at least 12 lots of highway bundles of over 6000 Km before 2024. Indian Railways aims to achieve electrification of 27000 Km of tracks. The Minister said that the government has commissioned 550 wi-fi facilities in as many stations. Four station re-development projects and operation of 150 passenger trains would be done through PPP mode. More Tejas type trains will connect iconic tourist destinations. High speed train between Mumbai to Ahmedabad would be actively pursued. 148 km long Bengaluru Suburban transport project at a cost of Rs.18600 crore, also announced. Similarly, 100 more airports would be developed by 2024 to support Udaan scheme. Air fleet number expected to go up from the present 600 to 1200 during this time. Economic activity along river banks to be energised as per Prime Minister’s Arth Ganga concept.

Culture and Tourism

On Culture and Tourism, establishment of an Indian Institute of Heritage and Conservation under Ministry of Culture proposed with the status of a deemed University. 5 archaeological sites to be developed as iconic sites with on-site Museums at – Rakhigarhi (Haryana), Hastinapur

(Uttar Pradesh) Shivsagar (Assam), Dholavira (Gujarat) and Adichanallur (Tamil Nadu). Museum on Numismatics and Trade to be located in the historic Old Mint building Kolkata. Four more museums from across the country to be taken up for renovation and re-curation. Support for setting up of a Tribal Museum in Ranchi (Jharkhand). Maritime museum to be set up at Lothal-the Harrapan age maritime site near Ahmedabad, by Ministry of Shipping.

Environment and Climate Change

On Environment, States that are formulating and implementing plans for ensuring cleaner air in cities above one million to be encouraged. Parameters for the incentives to be notified later by the Ministry of Environment, Forests and Climate change and the allocation for this purpose was made about Rs. 4,400 crore for 2020-21.

Tax Proposals

In order to provide significant relief to the individual taxpayers and to simplify the Income-Tax law, the Finance Minister has proposed to bring a new and simplified personal income tax regime, wherein income tax rates will be significantly reduced for the individual taxpayers who forego certain deductions and exemptions.

| Taxable Income Slab (Rs.) | Existing Tax Rates | New Tax Rates |

| 0-2.5 Lakh | Exempt | Exempt |

| 2.5-5 Lakh | 5% | 5% |

| 5-7.5 Lakh | 20% | 10% |

| 7.5-10 Lakh | 20% | 15% |

| 10-12.5 Lakh | 30% | 20% |

| 12.5-15 Lakh | 30% | 25% |

| Above 15 Lakh | 30% | 30% |

In order to increase the attractiveness of the Indian Equity Market and to provide relief to a large class of investors, the Finance Minister has proposed to remove Dividend Distribution Tax (DDT), and adopt the classical system of dividend taxation, under which the companies would not be required to pay DDT. The dividend shall be taxed only in the hands of the recipients at their applicable rate.

In order to attract investment in the power sector, it has been proposed to extend the concessional corporate tax rate of 15% to new domestic companies engaged in the generation of electricity.

To incentivise investment by Sovereign Wealth Fund of foreign governments, the Finance Minister has proposed to grant 100% tax exemption to their interest, dividend and capital gains income in respect of the investment made in infrastructure and other notified sectors before 31st March, 2024 and with a minimum lock-in period of 3 years.

An eligible Start-up having turnover upto 25 crore is allowed deduction of 100% on its profits for three consecutive assessment years out of seven years if the total turnover does not exceed 25 crore rupees. The Finance Minister has proposed to increase this limit to Rs. 100 crore. She has also proposed to extend the period of eligibility for claim of deduction from the existing 7 years to 10 years.

Under the proposed ‘Vivad se Vishwas’ scheme, a taxpayer would be required to pay only the amount of the disputed taxes and will get complete waiver of interest and penalty, provided he pays by 31st March, 2020. Those who will avail the scheme after 31st March, 2020 will have to pay some additional amount. The scheme will remain open till 30th June 2020.

In order to further ease the process of allotment of PAN, a system will be launched under which PAN shall be instantly allotted online on the basis of Aadhaar, without any requirement for filling up of detailed application form.

A simplified GST return shall be implemented from the 1st April, 2020. It will make return filing simple with features like SMS based filing for nil return, return pre-filling, improved input tax credit flow and overall simplification. Dynamic QR-code is proposed for consumer invoices. GST parameters will be captured when payment for purchases is made through the QR-code.

Labour intensive sectors in MSME are critical for employment generation. Cheap and low-quality imports are an impediment to their growth. Keeping in view the need of this sector, customs duty is being raised on items like footwear and furniture. Rate of Duty for footwear is being raised from 25% to 35%; and for “parts of footwear” from 15% to 20%. Rate of Duty for specified Furniture goods is being raised from 20% to 25%.

To give impetus to domestic industry, and to generate resource for health services, it is proposed to impose a nominal health cess of 5% on imports of specified medical equipment. Basic customs duty on imports of newsprint and light-weight coated paper is being reduced from 10% to 5%.

An increase is proposed in National Calamity Contingent Duty (NCCD) on Cigarettes and Tobacco products. NCCD on Bidis remains unchanged.

New Economy

On New Economy, the Minister said that a policy to enable private sector to build Data Centre parks throughout the country will be brought out soon. Fibre to the Home (FTTH) connections through Bharatnet will link 100,000 gram panchayats this year.

It is proposed to provide Rs.6000 crore to Bharatnet programme in 2020-21. It is also proposed to provide an outlay of Rs.8000 crore over a period of five years for the National Mission on Quantum Technologies and Applications.

Budget – An Overview

Budget Estimates for 2020-2021 (in crore)

| Pension | 2,10,682 | Interest | 7,08,203 |

| Defence | 3,23,053 | IT and Telecom | 59,349 |

| Major Subsidies | 2,27,794 | Planning and Statistics | 6,094 |

| Agriculture and Allied Activities | 1,54,775 | Rural Development | 1,44,817 |

| Commerce & Industry | 27,227 | Scientific Departments | 30023 |

| Development ofNorth East | 3,049 | Social Welfare | 53,876 |

| Education | 99,312 | Tax Administration | 1,52,962 |

| Energy | 42,725 | Transfer to States | 2,00,447 |

| External Affairs | 17,347 | Transport | 1,69,637 |

| Finance | 41,829 | Union Territories | 52,864 |

| Health | 67,484 | Urban Development | 50,040 |

| Home Affairs | 1,14,387 | Others | 84,256 |

| Grand Total | 30,42,230 |